Resource Market Insights – September 2024

COPPER, GOLD, AND URANIUM: THE WINNING TRIO AS RATES SHIFT

Mid-Year Market Update: Optimism in Metals and Mining Amid Fed Rate Cut Expectations

As fiscal Q3 2024 concludes, the macroeconomic outlook for equity and commodity markets appears promising. This optimism stems largely from Federal Reserve officials signaling openness to further interest rate cuts, though they remain cautious and data-driven in their decision-making. While some officials advocate for gradual reductions due to concerns over inflation and employment, others warn about persistent inflationary risks. Ongoing debate surrounds the neutral rate’s post-pandemic level, with uncertainty over whether it’s temporarily or permanently elevated. Fed Chair Powell has noted progress toward the 2% inflation target, emphasizing the importance of balancing employment and price stability. With the Fed’s benchmark rate still high at 4.75%-5.00%, investors expect at least a quarter-point cut in November, contingent on economic data.

This evolving landscape is favorable for metals and mining stocks, particularly uranium, gold, and copper—commodities we remain bullish on.

Uranium: Despite a mid-year dip due to concerns over overvalued uranium stocks and seasonal softness, August saw a significant rebound. North American uranium miners have surged in response to Kazakhstan’s Kazatomprom releasing lower-than-expected production guidance for 2024, with production expected between 25,000 and 26,500 tons—below market expectations. This shortfall, combined with China’s approval of a record 11 new nuclear reactors, has spurred optimism in the sector. We continue to add to our positions in uranium explorers and producers.

Gold: The precious metal has surged past $2,600/oz, reaching all-time highs, fueled by Powell’s remarks, central bank rate cuts, and persistent geopolitical tensions. Gold has gained over 27% in 2024, supported by significant central bank purchases and increased safe-haven demand due to conflicts in the Middle East and Ukraine. Strong physical bar buying in the OTC market has further bolstered gold’s performance.

Source: Bloomberg

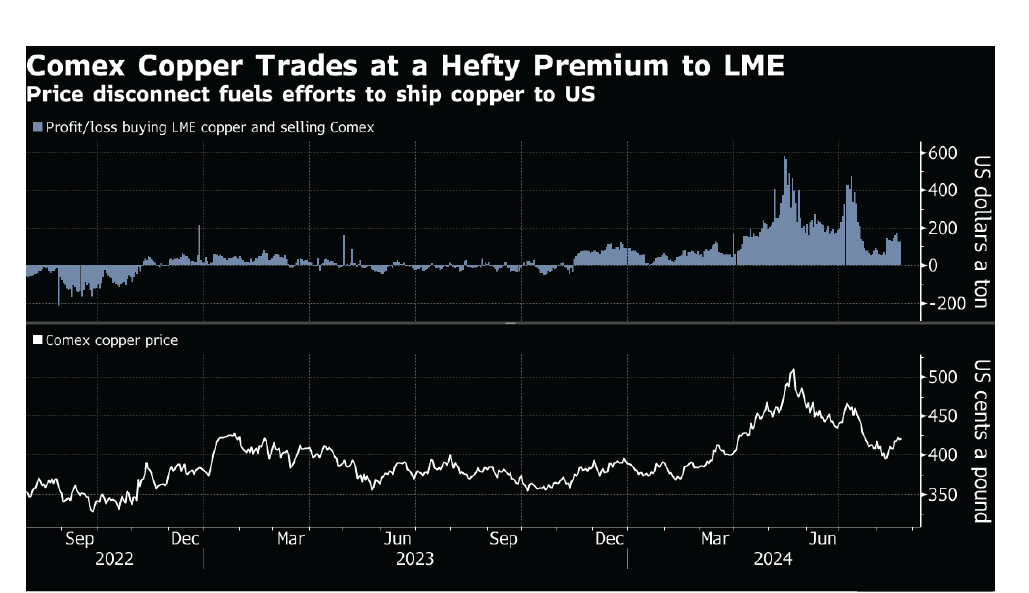

Copper: The copper market is experiencing dramatic shifts. After a sharp price surge on the New York Comex in May, a significant inflow of copper has reached the US. Chinese buyers, dealing with an oversupply and diminished domestic consumption, have redirected shipments to the US, where copper prices have soared. Notably, the cargo ship Ricarda, initially destined for China, was rerouted to the US, underscoring the market’s volatility. In July, US copper imports hit about 91,000 tons, one of the largest monthly totals in a decade, with projections for August suggesting up to 140,000 tons. This influx is easing supply constraints in the US but introduces potential challenges, such as oversupply and fluctuating Comex premiums.

Source: Bloomberg

Overall, lower rates are expected to boost base metal prices by stimulating economic growth and increasing demand. With our forecast for reduced policy rates by year-end, we remain optimistic about copper, despite recent market volatility due to China’s actions.

Consolidation Surge: How Recent M&A Activity is Shaping the Canadian Junior Mining Sector

The surge in mergers and acquisitions (M&A) within the Canadian junior mining sector is setting the stage for substantial stock price appreciation as we move through the remainder of 2024. Recent high-profile deals underscore a robust trend in consolidation, with significant transactions like Calibre Mining’s acquisition of Marathon Gold for $345 million, Yintai Gold’s purchase of Osino Resources for $368 million, and Silvercorp Metals’ acquisition of Orecorp for $186 million. This wave of M&A activity highlights growing investor confidence and strategic realignment in the sector.

One of the most noteworthy developments is Osisko Mining’s recent agreement to be acquired by Gold Fields for approximately $2.16 billion, marking a 55% premium over its recent trading price. This premium reflects the strategic value placed on Osisko’s assets and signals strong market expectations for the future. Additionally, Harfang Exploration’s acquisition of NewOrigin Gold and Reyna Silver’s merger with Reyna Gold further illustrate the sector’s consolidation trend, enhancing operational efficiency and creating more substantial, well-capitalized entities.

The increased M&A activity not only consolidates valuable assets but also strengthens the market position of the involved companies, leading to greater investor interest and potential for future growth. As these transactions are completed, they are expected to drive up stock prices by signaling stability and growth potential in a sector known for its volatility. With improved asset portfolios and enhanced capital access, these companies are well-positioned to capitalize on exploration and development opportunities, which could translate into significant stock price appreciation for the remainder of the year.

Summary

The recent positive developments in uranium, gold, and copper markets highlight a favorable outlook for the Canadian junior mining sector. Uranium’s rebound, gold’s strength driven by geopolitical tensions, and copper’s influx into the US underscore the sector’s growth potential. As these commodities gain momentum, Canadian juniors are well-positioned to benefit from rising prices and increased global demand. Additionally, the current market dynamics create a fertile environment for acquisitions, which can further drive value and consolidate opportunities within the sector. This combination of favorable market conditions and strategic acquisition potential makes Canadian juniors an attractive investment proposition.

Glenn G. Drodge, CFA Senior Portfolio Manager