Resource Market Insights – September 2025

CANADIAN RESOURCE MARKETS POISED FOR GROWTH

AMID ECONOMIC UNCERTAINTY

Understanding the Forces Driving Resource Market

As we enter the final quarter of 2025, global markets are being shaped by a series of economic and geopolitical developments, many of which, while challenging for broad markets, are creating strong tailwinds for the resource sector.

A key concern is the weakening labour market in both Canada and the United States. On September 5, the U.S. reported disappointing job numbers: only 22,000 jobs were added in August, while unemployment rose to 4.3%, the highest level since 2021. Coupled with downward revisions to previous months, slowing wage growth, and fewer job openings, the data signals a broader economic slowdown.

As a result, markets are increasingly confident the U.S. Federal Reserve will begin cutting interest rates, potentially as early as its September 16–17 meeting. Money markets are now pricing in nearly three rate cuts before year-end. Yet, these anticipated cuts are occurring in an environment where inflation remains stubbornly high, putting the Fed in a difficult position, accused of being “behind the curve” and raising concerns about its credibility and future policy effectiveness.

Despite this uncertainty, along with ongoing trade tensions and persistent geopolitical risks in Ukraine and the Middle East, global equity markets have remained surprisingly resilient. August saw indices close near all-time highs, buoyed by the prospect of lower interest rates and the announcement of several new U.S. trade agreements. One notable development with direct implications for the resource sector is President Trump’s recent executive order to exempt key metals, including graphite, tungsten, uranium, and gold bullion from country-specific tariffs. This procedural shift not only removes barriers to resource trade but also paves the way for fast-tracked, country-to-country deals. In effect, this eases the flow of critical minerals and metals into the U.S. and removes pricing pressure for non-domestically produced commodities.

The Junior Mining Sector: A Breakout Year

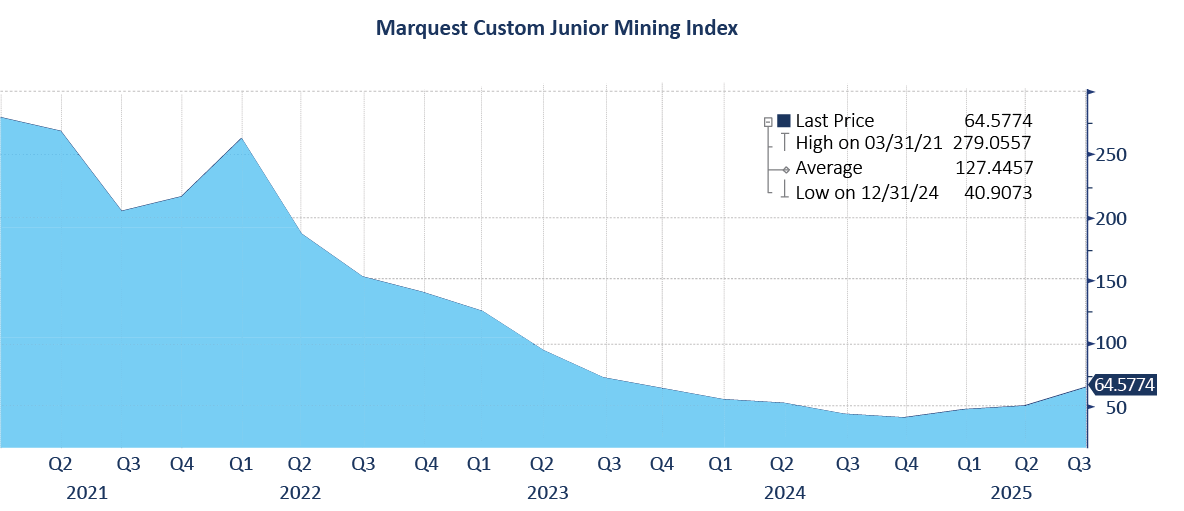

Amid this complex macro backdrop, 2025 has emerged as a breakout year for Canadian-listed junior mining companies. As shown below, the Marquest Custom Junior Mining Index, which tracks hundreds of Canadian juniors via Bloomberg, has delivered a robust 60%+ return year-to-date.

This rally is being driven by a broad-based recovery in key commodities, investor demand for real assets, and a shift in capital toward earlier-stage exploration opportunities. Typically, junior mining equities and commodity prices have low correlation.

Source: Bloomberg

But this year, we are seeing synchronized strength:

• Copper is up ~10% YTD, driven by structural supply deficits and rising electrification demand

• Gold has surged ~38%, as macro uncertainty fuels safe-haven buying

• Uranium has rallied ~20% from its March lows, with long-term supply-demand fundamentals improving.

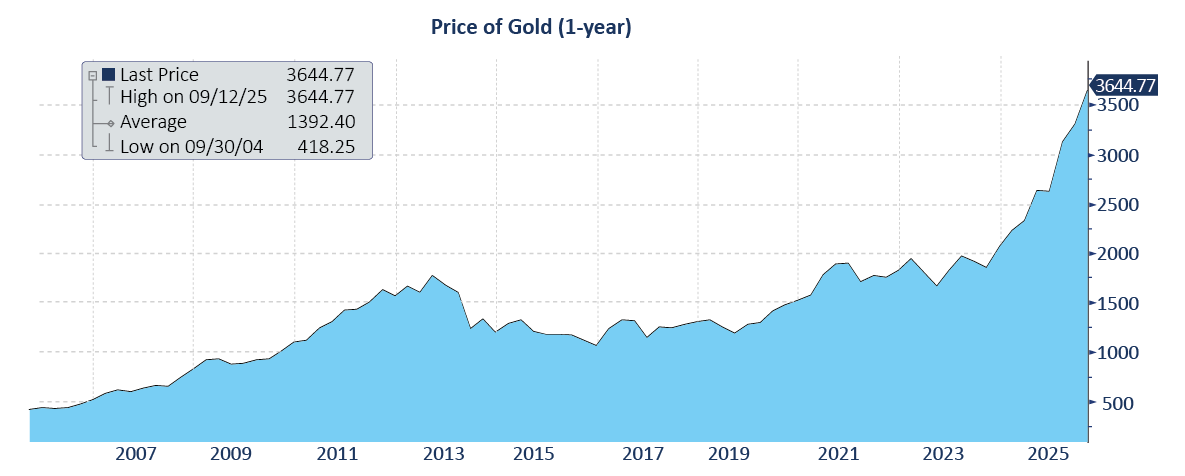

Spotlight: Gold Surpasses $3,600/oz

• Gold continues to grab headlines, reaching record highs above $3,600/oz, driven by a unique convergence of macro forces.

Source: Bloomberg

Key drivers include:

• Rate cut expectations: Weak jobs data in both Canada and the U.S. have increased the probability of aggressive central bank easing. Lower rates reduce the opportunity cost of holding gold, boosting demand.

• Safe haven flows: Investors are growing skeptical of the U.S. Federal Reserve’s independence, especially as political pressure mounts. A court ruling on whether President Trump can remove Fed Governor Lisa Cook could tip the balance toward a more dovish Fed, fueling speculation and volatility.

• Geopolitical risk: Global instability has reinforced gold’s role as a store of value.

• Foreign central bank demand: China’s central bank has been aggressively accumulating gold, purchasing it for ten consecutive months. As of August 2025, China’s holdings stand at 74.02 million fine troy ounces, a clear signal of shifting global reserve strategies.

• ETF flows: Investor inflows into gold ETFs have doubled over the past two years, reaching record levels, as shown in the following chart.

Source: Bloomberg Note: 2025 Q3 is quarter-to-date

Why This Matters for Investors, and Why Now Is the Time to Act

These powerful tailwinds have created a rare and compelling opportunity for investors in Canada’s junior mining sector. Exploration-stage companies are gaining renewed attention as capital flows into hard assets, safe havens, and critical mineral supply chains.

This is where Marquest’s Super Flow-Through Limited Partnerships come in.

Why This Matters for Investors, and Why Now Is the Time to Act

Amid rising gold prices, accelerating demand for critical minerals, and renewed investor interest in junior miners, Marquest’s 2025 Limited Partnerships are suitable at this time. The Marquest Critical Minerals 2025 Super Flow-Through LP provides diversified exposure to exploration companies driving the global energy transition, while the Marquest Mining Québec 2025-II Super Flow-Through LP targets high-potential juniors in one of the world’s top mining jurisdictions, with exposure to Québec’s resource tax credits, particularly for critical and strategic mineral development.

Both funds offer powerful flow-through tax benefits, direct access to early-stage upside, and a timely way to capitalize on the sector’s momentum. With capital rotating into real assets and Canada re-emerging as a leader in exploration, these partnerships offer a smart, tax-efficient way to participate in the next phase of the commodity cycle.

Glenn G. Drodge, CFA Senior Portfolio Manager